7. TDS

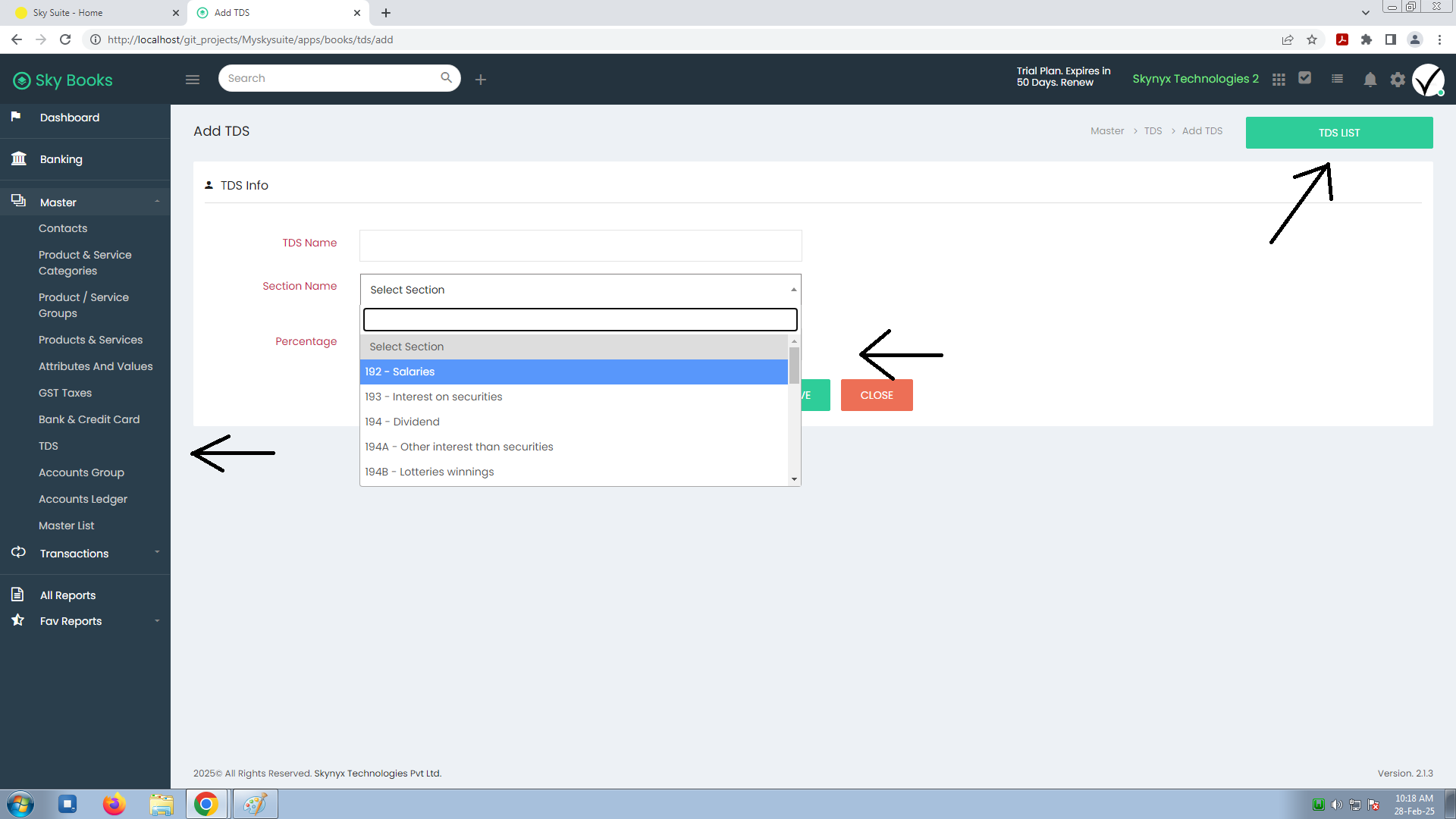

How to Add a New TDS

- Click "Add New TDS" at the top of the TDS Info table.

- Fill in the fields:

- TDS Name: Provide a name (e.g., Rent, Commission).

- Section Name: Select or type the relevant Income Tax Section (e.g., 194H).

- Percentage: Enter the percentage rate of TDS (e.g., 10%).

- Save your TDS entry.

Using TDS in Transactions

After adding TDS details, you can apply them to relevant transactions, such as:

- Invoices: When creating invoices for clients, you can apply the appropriate TDS deduction based on the type of service or product.

- Payments: TDS can also be applied when making payments to suppliers or contractors, ensuring accurate tax deductions.

| S.NO | TDS NAME | SECTION NAME | PERCENTAGE |

|---|---|---|---|

| 1 | Commission or Brokerage | 194H - Commission or Brokerage | 5% |

| 2 | Dividend | 194 - Dividend | 10% |

| 3 | Other interest than securities | 194A - Other interest than securities | 10% |

| 4 | Payment of contractors for Others | 194C - Payment of contractors for others | 2% |

| 5 | Payment of contractors HUF/Individual | 194C - Payment of contractors HUF/Individual | 1% |

| 6 | Professional Fees | 194J - Professional Fees | 10% |

| 7 | Rent on land or furniture etc | 194I - Rent on land or furniture etc | 10% |