2. Bills

Bills allow you to track purchases made from vendors, manage the payment schedule, and calculate taxes and discounts. In Sky Books, you can easily create, manage, and send bills based on vendor transactions.

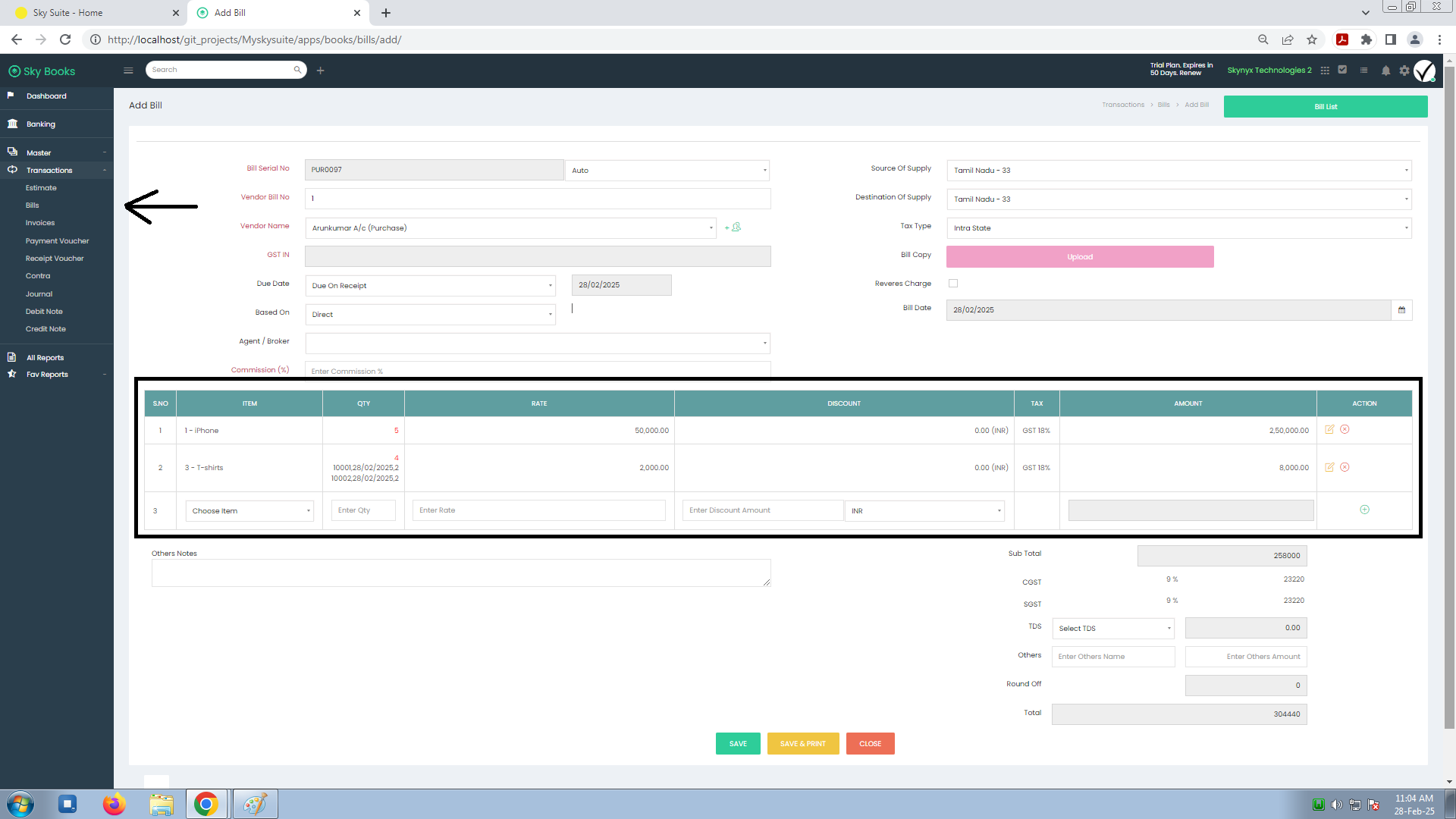

How to Add a Bill

-

Navigate to the Bills Section

- Go to Transactions from the sidebar menu.

- Select Bills to view existing bills or to create a new bill.

-

Add New Bill

- Click on Add Bill to create a new bill.

-

Fill in Bill Details

- Bill Serial No: Sky Books will automatically generate a bill number (e.g., PUR0097), but you can customize it if needed.

- Vendor Bill No: Enter the bill number provided by the vendor (e.g., 1).

- Vendor Name: Choose the vendor from your contact list or add a new one.

- GST IN: Enter the vendor’s GST Identification Number.

- Due Date: Specify the due date for payment (e.g., 28/02/2025).

- Based On: Choose the basis for the bill (e.g., Agent / Broker).

- Commission (%): If applicable, enter the commission percentage for the transaction.

- Source of Supply: Enter the location where the goods are supplied from.

- Destination of Supply: Enter the destination where the goods are supplied to.

- Tax Type: Choose the applicable tax type for the bill (e.g., GST).

- Bill Copy: Optionally, you can upload a copy of the bill for reference.

- Reverse Charge: Specify if reverse charge is applicable for this transaction.

- Bill Date: The date the bill is issued (e.g., 28/02/2025).

Tax Calculation & Item Details

After entering the bill details, you can add items and calculate tax for each:

- Item: Choose or enter the product or service.

- Quantity (QTY): Enter the quantity purchased.

- Rate: Enter the rate per unit (exclusive of tax).

- Discount: If applicable, enter any discounts on the product.

- Tax: Select the appropriate tax rate (e.g., GST 18%).

- Amount: The system will automatically calculate the total amount (Qty x Rate + Tax).

Additional Information and Totals

Once the items are listed, Sky Books will calculate the Subtotal, CGST, SGST, and TDS automatically based on the entered values.

-

Others Notes: You can add any custom notes or instructions, such as special agreements or delivery instructions.

-

Sub Total: Sky Books calculates the subtotal amount of the items, excluding taxes.

- Example: 258,000 INR.

-

CGST (Central Goods and Services Tax): Sky Books will calculate CGST based on the tax rate (e.g., 9% of the subtotal).

- Example: CGST 9% = 23,220 INR.

-

SGST (State Goods and Services Tax): Sky Books will calculate SGST based on the tax rate (e.g., 9% of the subtotal).

- Example: SGST 9% = 23,220 INR.

-

TDS (Tax Deducted at Source): If applicable, the TDS amount will be deducted.

- Example: TDS = 0.00 INR.

-

Others: You can add additional charges, such as shipping fees or handling charges.

- Example: Others Name: Delivery Fee, Others Amount: 500 INR.

-

Round Off: Sky Books will round the final total based on the rounding settings you have configured in the system.

- Example: Round Off: 0 INR.

-

Total: The final total will include the subtotal, taxes, other charges, and round-off.

- Example: Total = 304,440 INR.

Benefits of Using Bills in Sky Books

- Accurate Tax Calculation: Automatically calculate taxes like CGST, SGST, and TDS.

- Vendor Management: Keep track of vendor details, payment due dates, and bill statuses.

- Customizable: Add notes, discounts, and additional costs to your bills.

- Easy Tracking: Organize and track all your bills in one place to ensure timely payments.