9. Credit Note

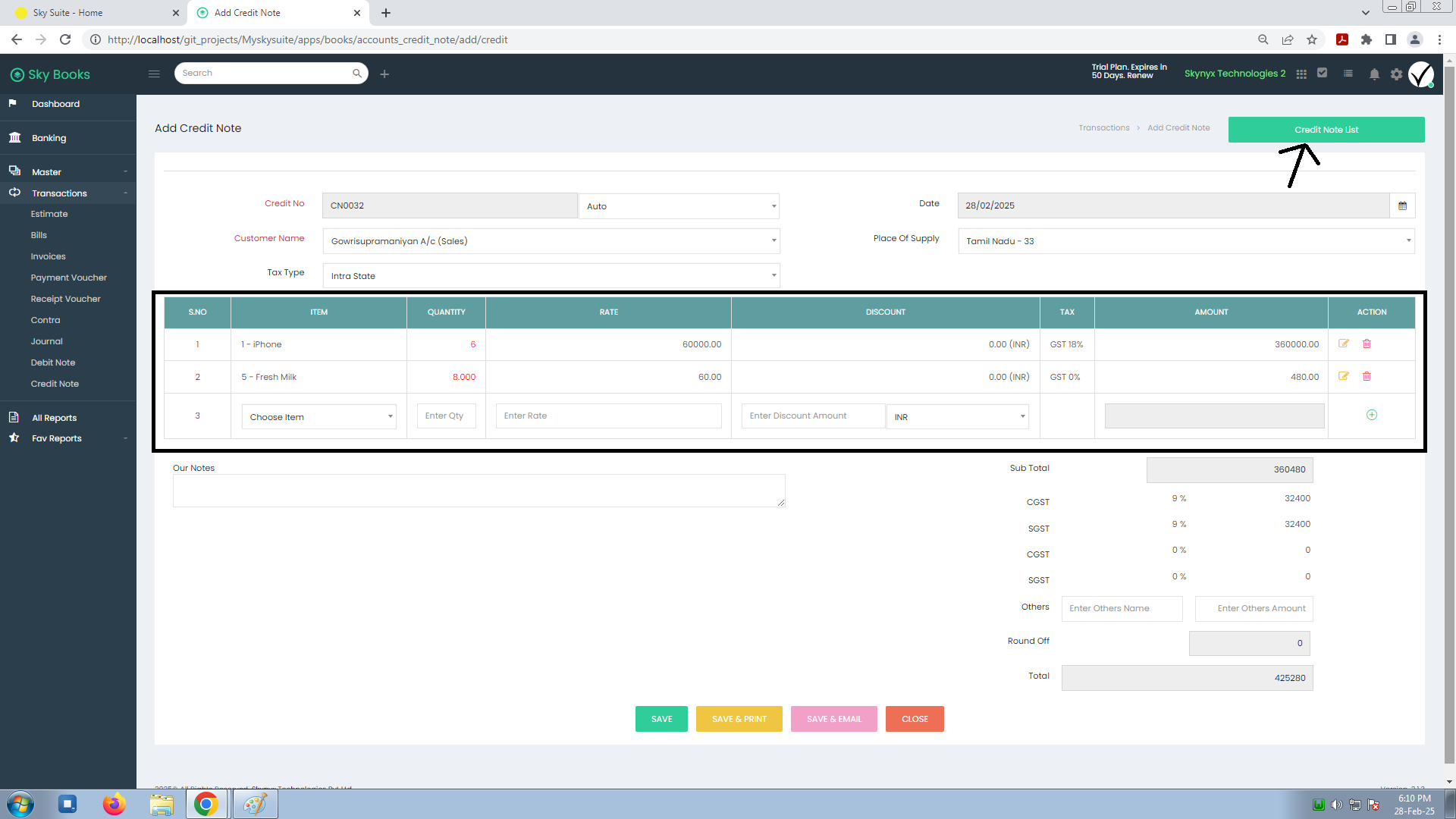

Add Credit Note

The Credit Note feature allows users to record adjustments for returns or corrections of invoices. Here a detailed guide on creating a Credit Note in Sky Books.

Credit Note Details

-

Credit No: Sky Books will automatically generate a Credit Number (e.g., CN0032), or you can customize it.

-

Customer Name: Select the customer from your contact list or add a new one if required.

-

Tax Type: Select the applicable tax type for the transaction (e.g., GST).

-

Date: Enter the date for the credit note (e.g., 28/02/2025).

-

Place of Supply: Enter the place of supply for the transaction (e.g., Delhi).

Item Details

Under the Item Details section, list the items that are being returned or adjusted:

- Item: Choose or enter the product being adjusted (e.g., 1 - iPhone).

- Quantity: Enter the quantity of the items being adjusted (e.g., 6).

- Rate: Enter the rate per unit (e.g., ?60,000.00).

- Discount: Enter any discount applied (if applicable).

- Tax: The system will apply the tax rate (e.g., 18% GST).

- Amount: Sky Books will automatically calculate the total amount based on the Quantity, Rate, Discount, and Tax.

Additional Information

-

Our Notes: Add any custom notes related to the credit note (e.g., "Adjustment due to returned goods").

-

Others: Enter any additional charges related to the credit note (e.g., shipping fees, handling charges).

- Others Name: Enter the name of the additional charge (e.g., Delivery Fee).

- Others Amount: Enter the amount for the additional charge (e.g., ?500).

Calculation of Totals

Sky Books will automatically calculate:

-

Sub Total: The sum of all item amounts before tax.

Example: Sub Total = ?360,000 + ?480 = ?360,480

-

CGST (Central Goods and Services Tax): The tax amount for CGST (if applicable).

Example: CGST @ 9% = ?32,400 (on ?360,000).

-

SGST (State Goods and Services Tax): The tax amount for SGST (if applicable).

Example: SGST @ 9% = ?32,400 (on ?360,000).

-

Others: Additional charges (if any) are added here.

-

Round Off: If required, Sky Books will round off the final total to the nearest value.

Final Amount Calculation

- Total: The final total will include the subtotal, taxes, additional charges, and any round-off adjustments.

Benefits of Using Credit Notes in Sky Books:

-

Track Adjustments: Efficiently manage product returns, corrections, and adjustments.

-

Automatic Tax Calculation: Automatic application of GST or other applicable taxes ensures accuracy.

-

Vendor Management: Easily track customer transactions and balances.

-

Customizable: Add extra charges, custom notes, and adjustments to provide a more detailed and accurate credit note.