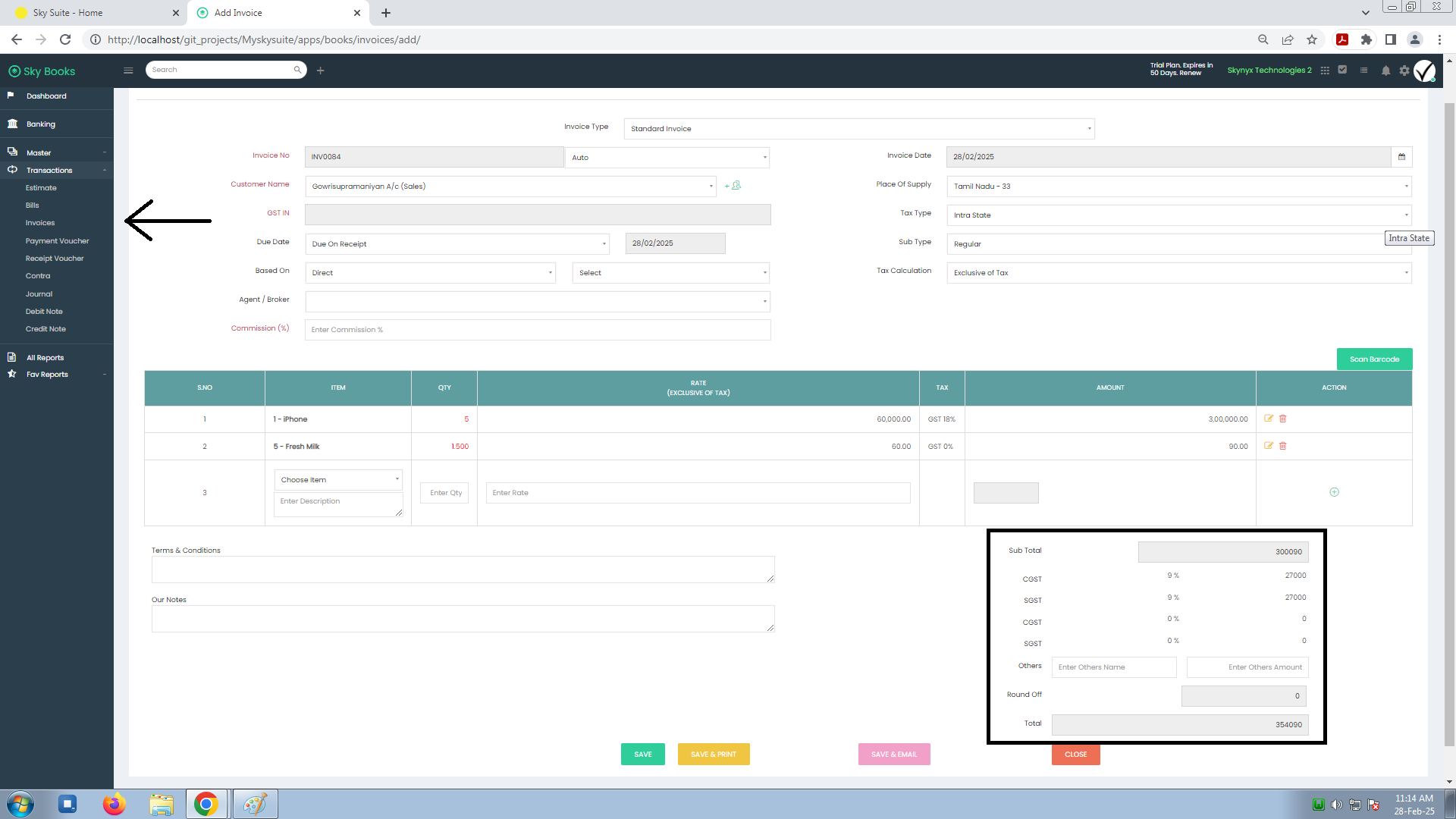

3. Invoices

How to Add an Invoice in Sky Books:

-

Navigate to the Invoice Section:

- Go to the Transactions section from the sidebar.

- Click on Invoices to view existing invoices or add a new one.

-

Add New Invoice:

- Click on Add Invoice to create a new invoice.

-

Fill in Invoice Details:

- Invoice Type: Select the appropriate invoice type (e.g., Sales Invoice, Service Invoice).

- Invoice No: Sky Books will auto-generate the invoice number (e.g., INV0084), but you can customize it if needed.

- Customer Name: Select the customer from your contacts list.

- GST IN: Enter the customer’s GST Identification Number.

- Due Date: Set the due date for payment (e.g., 28/02/2025).

- Invoice Date: Set the issue date for the invoice (e.g., 28/02/2025).

- Place of Supply: Enter the place of supply (this can vary based on your country’s GST regulations).

- Tax Type: Choose the tax type (e.g., GST).

- Sub Type: Choose the sub-type of the tax if applicable.

- Based On: Select whether the invoice is based on an order, quote, etc.

- Agent / Broker: If an agent or broker is involved, specify their details.

- Commission (%): Enter the agent/broker commission percentage if applicable.

-

Tax Calculation & Item Details:

- S.NO: Serial number for each item listed.

- Item: Select the product or service being sold (e.g., iPhone, Fresh Milk).

- QTY (Quantity): Enter the quantity of each item sold.

- Rate (Exclusive of Tax): Enter the rate per unit for each item, excluding tax.

- Tax: Select the applicable tax rate (e.g., GST 18%).

- Amount: The system will calculate the total for each item (rate x quantity).

-

Terms & Conditions:

- Add any relevant terms and conditions for the invoice.

-

Additional Information:

- Our Notes: Add any notes to the customer, if necessary.

- Sub Total: Sky Books will automatically calculate the subtotal for the items listed.

- CGST & SGST (Tax Calculation): Sky Books will calculate the CGST and SGST based on the tax rate selected (e.g., CGST 9%, SGST 9%).

- Others: Add any extra charges (e.g., shipping or handling fees). Enter the name and amount of the extra charge.

- Round Off: The system will round off the total amount if needed.

-

Final Total:

- The system will display the final Total, including taxes, additional charges, and any adjustments for rounding.

Benefits of Using Sky Books Invoice Feature:

- Tax Calculation: Automatically calculates CGST, SGST, and other taxes.

- Comprehensive Invoice Details: Track all the details from the customer, items sold, tax rates, and additional charges.

- Customization: Add notes, terms, and customize commission and other charges.

- Easy Tracking: View and manage all your invoices in one place for easy follow-up and payment management.